Final Wednesday noticed the UK Authorities’s Spring Assertion on the financial system: primarily a response to a brand new forecast from the Workplace of Budgetary Accountability. This was politically painful – a deteriorating forecast implies that the federal government must both cut back public spending or enhance taxes to ensure that the forecasts to satisfy its self-imposed constraints on public borrowing and the deficit. These forecasts are at all times unsure, and extremely depending on what assumptions are made in regards to the future. This set of forecasts underline how necessary productiveness progress – or the shortage of it – is for the flexibility of the federal government to satisfy its commitments.

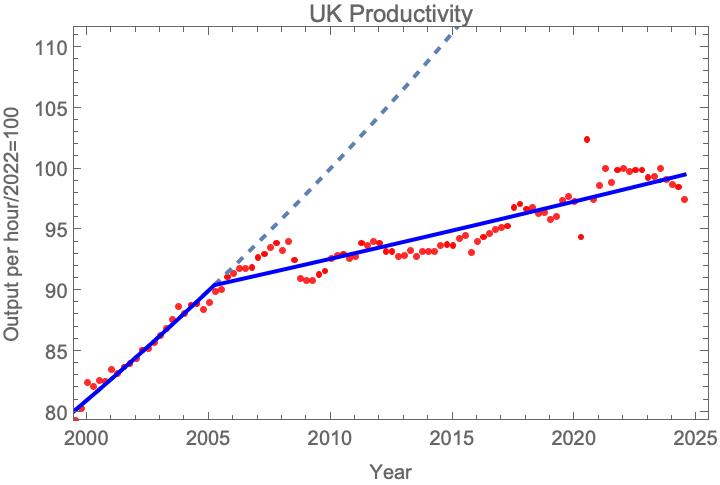

First, the place are we now? Right here is the newest productiveness knowledge. To recap, as I’ve been discussing for a while now, for a lot of the postwar interval, productiveness within the UK grew at a gentle fee of two.1% a 12 months. That modified within the mid-2000s, within the run-up to the worldwide monetary disaster; the expansion fee reasonably abruptly dropped to about 0.5% a 12 months. The cumulative impact is that the productiveness of the UK financial system is now some 28% under what it could have been if earlier development had continued.

UK Labour Productiveness index, quarterly knowledge. The stable blue line is a finest match to a operate which assumes two durations of exponential progress steady at a break level. See my submit When did the UK’s productiveness slowdown start? for particulars of the becoming methodology. One of the best match parameters are: pre-break progress fee: 2.1%, post-break progress fee: 0.48%, break at 12 months 2005.2. Information: ONS, Feb 18th 2025 launch.

Taking a extra close-up take a look at the final twenty years, one sees that there isn’t any signal of any restoration of productiveness progress. Quite the opposite, the previous couple of quarters appear discouraging. I feel it’s in all probability too early to conclude that we’re transferring right into a interval of even decrease productiveness progress – one wants to attend some time to see the long-term tendencies, and knowledge is commonly revised. As well as for the time being there may be a fear about high quality of the survey knowledge ONS makes use of to estimate complete hours labored, which provides additional uncertainty.

UK Labour Productiveness index, quarterly knowledge. Information: ONS, Feb 18th 2025 launch, match as within the plot above.

What’s the OBR predicting for the longer term? It’s central forecast is predicated on the idea that productiveness progress will increase by 2029 to a worth which is kind of the common of the pre-break and post-break values – 1.25%, with a rise of 0.2% to the expansion fee attributed to planning reforms resulting in extra house-building. It has additionally modelled the impact of an upside state of affairs, the place productiveness progress of 1.2% is achieved in 2025, and a draw back state of affairs persevering with current decrease development progress of 0.3% a 12 months.

UK Labour Productiveness index, annual knowledge, along with the OBR’s March 2025 eventualities for productiveness progress as much as 2029. Gray is the primary March forecast, yellow & inexperienced are excessive and low productiveness progress eventualities.

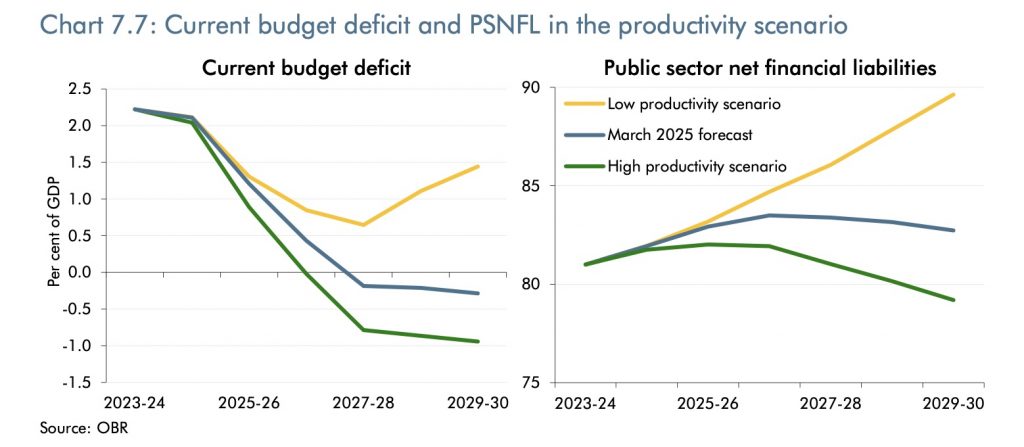

The subsequent plot, from the OBR report, reveals how a lot distinction assumptions about productiveness progress make to the fiscal projections. With out the idea that productiveness progress is about to extend considerably over the development it’s adopted for the final 15 years, the federal government’s fiscal targets for the debt and the deficit can’t be met. On this state of affairs, the federal government would wish both to chop public spending additional or enhance taxes to satisfy these targets.

Impact of the totally different productiveness progress eventualities on the OBRs fiscal forecasts. From the March 2025 Financial and Fiscal Outlook.

So, large selections in regards to the UK’s fiscal coverage are being made on the idea of predictions of future productiveness progress, and the query of whether or not the federal government will meet its fiscal targets are very delicate to the assumptions being made. How a lot credence can we place on these forecasts? It does must be pressured that the OBRs report on predicting productiveness progress has been persistently overoptimistic since its institution, because the plot under reveals. I feel this displays a wider failure by the UK’s financial and policy-making group to understand the dimensions of the change to the UK financial system within the Nineteen Nineties and 2000s and its long run results. There isn’t a extra necessary financial coverage query than to grasp the causes of the productiveness slowdown – and to search out insurance policies to reverse this.

Successive OBR forecasts of productiveness and outturn. Supply: OBR